International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global

Alex Picot Trust :: The 'protected settlement' – a silver lining to UK resident non-dom tax reforms?

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global

Part I Section 901.—Taxes of Foreign Countries and of Possessions of the United States 26 CFR 1.901-2: Income, War Profits, o

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global

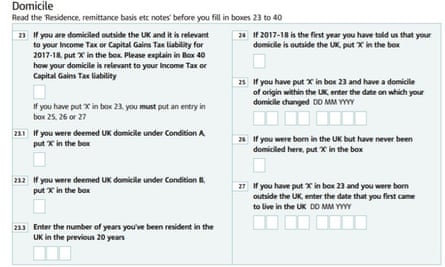

Akshata Murty's non-dom status is a choice not an obligation – tax experts | Tax and spending | The Guardian